CAIA考试是一门什么样金融考试

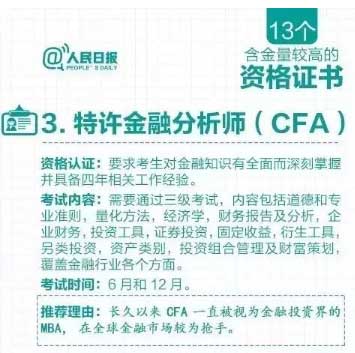

CAIA,即特许另类投资分析师,由位于美国马萨诸塞州的特许另类投资分析师协会 (Chartered Alternative Investment Analyst Association) 授予,是目前世界上唯一的针对专门从事另类投资的人士设计的教育标准。

CAIA考试由两个级别构成。CAIA一级运用投资分析审查各项另类投资资产的基本特性,CAIA二级则在一个资产配置与决策框架中运用这些分析。两个级别都包括了CAIA项目的基本组成部分:道德与专业行为。

CAIA一级课程涵盖的领域有:数量分析、监管架构、交易策略、表现度量、房地产、对冲基金、大宗商品、管理型期货、私募股权、信用衍生品等。

CAIA二级课程涵盖的领域有:资产配置、投资组合管理、风格分析、风险管理、结构性产品、指数化与基准、当前的课题与案例分析等。

CAIA官网关于CAIA介绍:

Distinguish yourself with knowledge, expertise, and a clear career advantage – become a CAIA Charterholder. CAIA? is the globally-recognized credential for professionals managing, analyzing, distributing, or regulating alternative investments.

Successful completion of two exams and Membership in the CAIA Association puts you among an elite group of more than 11,000 professionals worldwide. And, your education doesn’t end once you’ve passed and joined. Membership keeps you current and connected.

Earning the CAIA Charter is an investment in your career.

Relevant: Learn what you need to know for success and credibility in alternatives.

Current: Program materials are reviewed and updated regularly.

Efficient: 75% of Candidates who earn their CAIA Charter do so in 12 to 18 months.

Comprehensive: Two exam levels cover everything from the characteristics of various strategies within each alternative asset class to portfolio management concepts central to alternative investments.

Level I Topic(CAIA一级考试科目权重)

Approximate Exam Weight

Professional Standards and Ethics15-20%

Introduction to Alternative Investments20-25%

Real Assets including Commodities10-20%

Hedge Funds10-20%

Private Equity5-10%

Structured Products10-15%

Risk Management and Portfolio Management5-10%

Level II Topic(CAIA二级考试科目权重)

Multiple Choice Constructed Response

Professional Standards and Ethics0% 10%

Current and Integrated Topics0% 10%

Asset Allocation and Institutional Investors8-12% 0-10%

Private Equity11-15% 0-10%

Real Assets13-17% 0-10%

Commodities5-7% 0-10%

Hedge Funds and Managed Futures18-22% 0-10%

Structured Products5-7% 0-10%

CAIA一级侧重点:评估您对各种替代资产类别的理解,以及对用于评估每种资产的风险收益属性的工具和技术的了解。

CAIA二级侧重点:评估如何在投资组合管理环境中应用在第一级中学到的知识和分析。 两种考试都包括道德和职业操守部分。

行业科普

行业科普

发布时间:2019-11-12

发布时间:2019-11-12

复制本文链接

复制本文链接 模拟题库

模拟题库

221267

221267

>

>