CFA协会认可的工作经验。申请证书时的工作经验是如何确认的?如果我中途跳槽了,那以前的工作经验如何确认?难道还要去找老单位?

只需要您现在的雇主对你提交的工作经验签字认可并推荐您加入CFA协会,再加上一个CFA资格持有人推荐就可以了加入CFA协会并获取CFA头衔,工作经验可以在考前、考中和考后都可以累计。

申请成为CFA持证人需要多少年的工作经验?

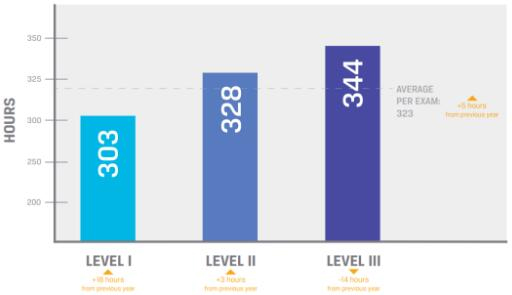

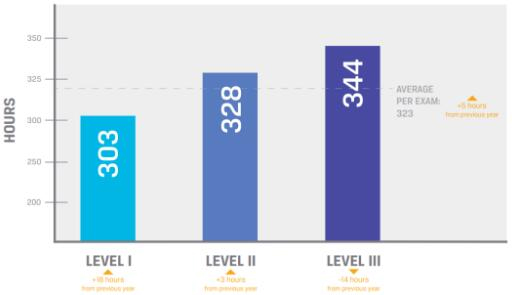

在通过CFA三级考试后,需要4年(48个月)被认可的专业工作经验,不论是参加CFA考试前、考试中、考试后积累的工作经验,都是被认可的。

被认可的工作经验有哪些?

认可的工作经验包括:直接参与投资决策过程或者为投资决策过程提供支持等相关工作。

参见以下职位列表和相关工作经验的描述:

职位列表举例

职位本身的名称不能直接决定是否被CFA协会认可,主要是日常工作中涉及到的职务内容必须50%以上和投资决策相关的才是被认可。如果所从事的工作在以下举例的职位以外,但工作中涉及的职务内容和投资决策相关,亦可提供详细的工作经验给CFA协会,也是被认可的。

工作职位列表:

Accountant

Actuary

Auditor

Compliance analyst/officer

Consultant

Corporate chief financial officer

Corporate finance analyst

Client service representative or relationship

manager

Derivatives analyst

Economist

Financial adviser

Financial journalist/editor

Institutional sales professional/business

development(buy and sell side)

Investment banking analyst

Investment consultant

Investment strategist

Investor relations

Mutual fund sales

Portfolio administrator

Portfolio manager

Private client investment adviser

Product/software developer

Professor/instructor

Quantitative investment or risk analyst

Real estate investment manager

Regulator

Securities trader

Securities underwriter

Security/investment analyst

Supervisor of investment firm

Valuator of closely held business

Venture capital analyst

工作经验描述

You must spend at least 50%of your time in the investment decision-making process in order for your work experience to qualify.Keep in mind that there are no"good"or"bad"job titles.Just tell us how your experience relates to the investment decision-making process and be as descriptive as possible.

Job Title

Work Experience Description

Descriptive Enough?

Portfolio Manager

Rebalance high-net-worth clients"portfolios by trading short-term assets and pooled funds.Analyze and evaluate client performance reports.

Yes

Rebalance portfolios;perform reporting.

No(too brief)

Securities Underwriter

Prepare financial models based on reviewed information;participate in the valuation and decision-making process;analyze fundamental and value acquisition targets for clients.

Yes

My company provides risk analysis and financial planning for customers.

No(does not describe job duties

Auditor

I perform financial statement audits of investment companies and in the process test the custody and pricing of the portfolios.Used Bloomberg and learned the accounting of several security types,including equities,bonds,options,and futures.

Yes

Review the internal control processes to ensure compliance with the requirements of the Sarbanes-Oxley Act and recommend process improvements.Perform non-SOX-related financial and operational audits on businesses to identify control and process weaknesses and recommend process improvements.

No(does not add value to the investment decision-making process)

Quantitative Investment Analyst

As a financial engineer in an asset management company,I am responsible for evaluating product development and using quantitative methods and tools to recommend asset

allocations,construct portfolios,and perform derivative analysis.

Yes

My work is related to product design and quantitative analysis.

No(too brief)

Consultant

I am a management consultant to the financial services industry,working with risk management functions,assisting clients in developing and refining statistically based credit risk models covering a diverse range of portfolios.

Yes

Management consulting for the financial services industry.

No(too brief)

Actuary

I perform projections,cash flow analysis,and durational analysis of individual health insurance policies.These activities have a direct bearing on the investments chosen to back the reserves for these blocks of business.

Yes

Support annual actuarial valuation process.Benefit calculations.

No(does not add value)

中国CFA考试网(www.cfa.cn)综合整理,来源:cfa.cn 若需引用或转载,请联系原作者,感谢作者的付出和努力!

CFA协会在2015年5月与全球财经教育品牌-高顿财经,正式签署协议,标志着CFA培训走向更为专业更为标准化的道路,势必会解决之前国内培训机构,教学标准参差不齐的现象.高顿与全球BPP,kaplan,新东方学术合作;高顿教育与前程无忧达成战略合作;高顿CFA中国地区36个城市CFA教学全覆盖...

截止2017年,我们累计培养出数十万财经人才,在超过10年以上的CFA办学经验里,我们见证了中国CFA考生的成长,相信在不久的未来.

选择CFA培训机构重要参考因素如下:培训机构规模和服务质量;师资力量如何;通过率怎么样;能否在职业发展、持证、实习等方面给予帮助;结识更多高端人脉。

中国CFA考试网(www.cfa.cn)综合整理,来源:cfa.cn 若需引用或转载,请联系原作者,感谢作者的付出和努力!

CFA协会介绍

CFA协会介绍

发布时间:2018-08-06

发布时间:2018-08-06

复制本文链接

复制本文链接 模拟题库

模拟题库

649

649

>

>