CFA一级考试形式:

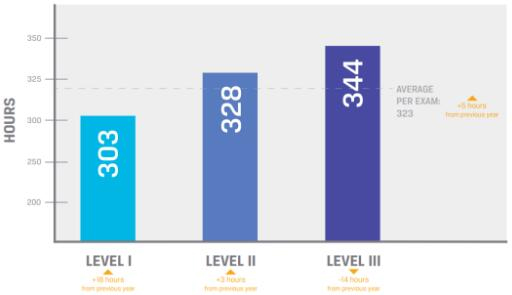

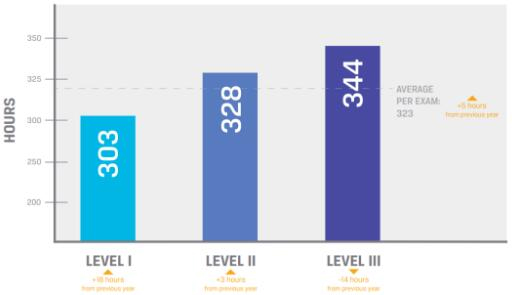

CFA考试分为LevelⅠ、LevelⅡ和LevelⅢ三个阶段,考生必须通过前一阶段才能参加次一阶段考试。高顿财经小编提醒各位:考生须于3年内通 过先进阶段考试,并在7年内完成三个阶段的考试。倘若考生在某一阶段未能考取合格成绩,隔年才能重新参加该阶段考试。考生必须于7年内通过三个阶段考试, 否则需重新注册,但考过的阶段将永久保留。

三个阶段的考试时间为6个小时,上、下午分别各三小时。先进阶段和第二阶段考试(LevelⅠ、LevelⅡ)形式为选择题(Multiple Choice),每卷各120题,共240题;第三阶段(LevelⅢ)的考试形势是50%的论文写作及50%的应用题(其中主要是案例分析)。

CFA的知识结构:

CFA考试内容涵盖甚广,主要包括:

①职业标准和操守;

②财务报表分析;

③量化分析;

④经济学;

⑤固定收益投资分析;

⑥股权分析;

⑦投资组合管理;

⑧企业金融;

⑨衍生工具;

⑩其他投资分析等等。

CFA一级考纲有哪些变化内容?

1.财务报告及分析 Financial Reporting and Analysis

SS7,R23.Financial Reporting Mechanics

新增考点:

1、describe how business activities are classified for financial reporting purposes

SS8,R25.Understanding Income Statements

新增考点:

1、describe key aspects of the converged accounting standards issued by the International Accounting Standards Board and Financial Accounting Standards Board in May 2014;

SS9,Reading 29: Inventories

调整考点:

1、calculate and compare cost of sales, gross profit, and ending inventory using different inventory valuation methods and using perpetual and periodic inventory systems;

新增考点:

1、calculate and explain how inflation and deflation of inventory costs affect the financial statements and ratios of companies that use different inventory valuation methods;

2、explain LIFO reserve and LIFO liquidation and their effects on financial statements and ratios;

3、convert a company’s reported financial statements from LIFO to FIFO for purposes of comparison;

4、describe implications of valuing inventory at net realisable value for financial statements and ratios;

5、explain issues that analysts should consider when examining a company’s inventory disclosures and other sources of information;

6、calculate and compare ratios of companies, including companies that use different inventory methods;

7、analyze and compare the financial statements of companies, including companies that use different inventory methods.

删除考点:

1、calculate and compare cost of sales, gross profit, and ending inventory using perpetual

and periodic inventory systems;

2、compare cost of sales, ending inventory, and gross profit using different inventory valuation methods;

3、calculate and interpret ratios used to evaluate inventory management.

SS9,Reading 30: Long-lived Assets

调整考点:

1、describe the different depreciation methods for property, plant, and equipment and calculate depreciation expense;

2、describe the different amortisation methods for intangible assets with finite lives and calculate amortisation expense;

3、describe how the choice of amortisation method and assumptions concerning useful life and residual value affect amortisation expense, financial statements, and ratios;

新增考点:

1、explain and evaluate how capitalising versus expensing costs in the period in which they are incurred affects financial statements and ratios;

2、describe how the choice of depreciation method and assumptions concerning useful life and residual value affect depreciation expense, financial statements, and ratios;

3、explain and evaluate how impairment, revaluation, and derecognition of property, plant, and equipment and intangible assets affect financial statements and ratios;

4、analyze and interpret financial statement disclosures regarding property, plant, and equipment and intangible assets;

5、explain and evaluate how leasing rather than purchasing assets affects financial statements and ratios;

6、explain and evaluate how finance leases and operating leases affect financial statements and ratios from the perspective of both the lessor and the lessee.

SS9,Reading 31: Income Taxes

调整考点:

1、explain recognition and measurement of current and deferred tax items;

2.投资组合管理 Portfoio Management

SS12,Reading 42. Risk Management: An Introduction

新增考点:

1、define risk management;

2、describe features of a risk management framework;

3、define risk governance and describe elements of effective risk governance;

4、explain how risk tolerance affects risk management;

5、describe risk budgeting and its role in risk governance;

6、identify financial and non-financial sources of risk and describe how they may interact;

7、describe methods for measuring and modifying risk exposures and factors to consider in choosing among the methods.

3.权益 Equity

SS14,Reading 50: Introduction to Industry and Company Analysis

调整考点:

1、explain how a company’s industry classification can be used to identify a potential “peer group” for equity valuation;

2、explain the effects of barriers to entry, industry concentration, industry capacity, and market share stability on pricing power and price competition;

3、describe industry life cycle models, classify an industry as to life cycle stage, and describe limitations of the life-cycle concept in forecasting industry performance;

SS14,Reading 51: Equity Valuation: Concepts and Basic Tools

调整考点:

1、explain the rationale for using price multiples to value equity, how the price to earnings multiple relates to fundamentals, and the use of multiples based on comparables;

4.固定收益 Fixed Incomne

SS15,Reading 53: Fixed-Income Markets: Issuance, Trading, and Funding

调整考点:

1、describe repurchase agreements (repos) and the risks associated with them.

SS15,Reading 55. Introduction to Asset-Backed Securities

调整考点:

1、describe securitization, including the parties involved in the process and the roles they play;

2、describe typical structures of securitizations, including credit tranching and time tranching;

3、describe types and characteristics of residential mortgage-backed securities, including mortgage pass-through securities and collateralized mortgage obligations, and explain the cash flows and risks for each type;

4、describe types and characteristics of non-mortgage asset-backed securities, including the cash flows and risks of each type;

5、describe collateralized debt obligations, including their cash flows and risks.

新增考点:

1、define prepayment risk and describe the prepayment risk of mortgage-backed securities;

SS16,Reading 57. Fundamentals of Credit Analysis

调整考点:

1、explain the four Cs (Capacity, Collateral, Covenants, and Character) of traditional credit analysis;

新增考点:

1、describe default probability and loss severity as components of credit risk;

5.另类投资 Alternatives

SS18,Reading 64.Introduction to Alternative Investments

调整考点:

1、describe issues in valuing and calculating returns on hedge funds, private equity, real estate, commodities, and infrastructure.

备考指南

备考指南

发布时间:2016-08-23

发布时间:2016-08-23

复制本文链接

复制本文链接 模拟题库

模拟题库

649

649