During acoupon period, Macaulay and modified durations decline smoothly in a “saw-tooth” pattern,assuming the yield-to-maturity is constant. When the coupon payment is made,the durations jump upward.

问题解释

首先,久期的大小随着到期时间的增加而增加,所以图形从整体来看呈现一个上升的趋势。接着我们来从权重变化的角度解释久期在付息日当天的向上“跳空”现象。我们以一个一年付息一次的债券为例,观察其在0.999999999年和1年的久期大小,也就是付息后的久期和付息前的久期变化。

付息后瞬间:

付息前瞬间:

首先解释,为什么会跳空

然后解释,为什么是向上跳空

考题

1.1. Assumingthe yield-to-maturity is constant, when the coupon payment is made, theduration

A. jumpsupward

B. jumps downward

C. remainconstant

Solution: A

During a coupon period, Macaulay andmodified durations decline smoothly in a “saw-tooth” pattern, assuming theyield-to-maturity is constant. When the coupon payment is made, the durationsjump upward.

1.2. Which ofthe following is correct regarding to the change of Macaulay duration as timepasses and immediately after coupon payment?

Timepassage Coupon payment

A. Decrease increase

B. Increase Decrease

C. Decrease Decrease

Solution:A

As time passes during the coupon period, the Macaulayduration declines smoothly and then jumps upward after the coupon is paid.

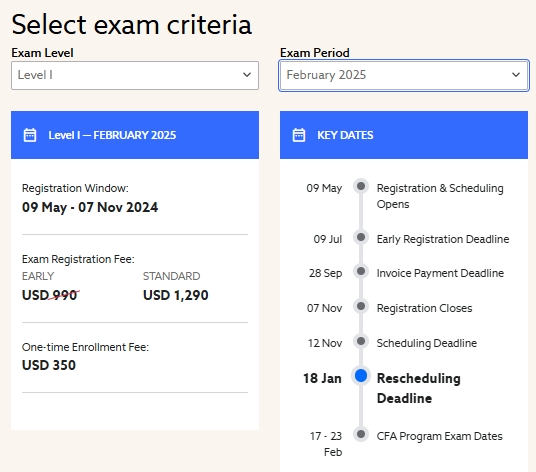

来自:金程CFA

学习资料

学习资料

发布时间:2014-12-21

发布时间:2014-12-21

复制本文链接

复制本文链接 模拟题库

模拟题库

221267

221267

>

>